RESOURCES FOR HOMEOWNERS

West Virginia Homeowners Rescue Program–NO LONGER ACCEPTING APPLICATIONS

The West Virginia Homeowners Rescue Program began operations on March 28, 2022. Over the past two years, the emergency COVID-relief program has helped more than 6,500 West Virginia households and committed more than $40 million in tax-free federal assistance. Because all funds are committed, the program is no longer accepting new applications or claims.

The program has helped homeowners with their past-due mortgage payments, utilities, homeowners’ insurance, property taxes, and other eligible costs, including home repair. Applicants did not have to have a mortgage or need assistance with their mortgage to apply for other types of assistance.

Read the program’s FAQs to learn more about program closure.

Loss Mitigation Measures

WVHDF customers who are facing financial difficulty but do not qualify for the Homeowners Assistance Program can still get help! Visit the Help for Homeowners page and complete the Mortgage Assistance Application. We will work with you to determine what assistance you may be eligible to receive.

Homeowners who are not WVHDF customers may still have access to mortgage assistance through their lenders. Contact your lender’s Loss Mitigation department to find out what programs and resources may be available to you.

Financial Counseling

COVID-19 was more than just a health crisis. It was an economic one, too. Financial counseling agencies are available to help homeowners throughout the state get their finances back on track. Services may include credit repair, creating and maintaining a budget, avoiding foreclosure, default counseling, and more. This article may help you understand more about the benefits of financial counseling. Visit the Counseling Agencies page at www.wvhdf.com/counseling-agencies to see a list of HUD-certified partner counseling agencies available in your area.

Every household can take basic steps to better understand and manage their finances. These steps include:

- Increase Savings: A family should have savings equal to two or three months of mortgage payments to protect their ability to work through a short term financial crisis.

- Track Monthly Expenses: A family should closely monitor monthly expenditures. Many families have no idea how much money they spend each month.

- Reduce Credit Card/Consumer Debt: Do not use credit cards for monthly expenses and stop the use of consumer credit for any purchases. Outstanding balances for consumer credit should not exceed your ability to payoff the total debt in 6 months. (Savings and Income). Families should save money to pay for purchases.

- Understand Home Maintenance: No home is free of repairs. Monthly action must be taken to prevent small problems (water drip under a sink) from becoming a large expense (flooring and a new cabinet). Extra care to the exterior of your home will help maintain the value of your home.

- Be Proactive: Call your creditors. Understand the terms of all your credit obligations, how to reduce fees and who to call if you are unable to make a scheduled payment. You have the power to stop collection calls. Make the first call at your convenience. Open your mail, read and ask questions if you do not understand information or notifications regarding your credit accounts.

- Find Supplemental Income: There are only two ways to improve your financial condition: spend less or increase income. If you already work two jobs then cutting expenses may be your solution. If not, a second job, if only for a year, could improve your financial condition. This solution ONLY works if expenses are held to prior monthly levels.

Counseling agencies: Click here to download graphics you can share on your Facebook or Instagram!

The United Way 211

211 of West Virginia has worked to address housing stability issues long before the pandemic started. In addition to utility assistance, 211 is a great resource for internet service assistance, home weatherization and repair, temporary financial assistance, transportation, and more. To contact 211:

- Dial 2-1-1 from your mobile device. (Please note that some phones that use VOIP (Voice Over Internet Protocol) or Wifi calling might not be able to reach 2-1-1. In that case, call 1-833-848-9905.)

- Text your Zip code to 898-211.

- Visit the 211 website at https://wv211.org/ and click “Chat” to speak with a specialist online.

211 specialists can also help homeowners determine if they are eligible for assistance through the West Virginia Homeowners Rescue Program. If homeowners are not eligible for the program or need help above and beyond what the program can provide, 211 can point them to additional resources that may be able to help them maintain their housing stability.

Home Repair and Weatherization Programs

At this time, neither the West Virginia Housing Development Fund nor the West Virginia Homeowners Rescue Program offer funding for home repair. However, there are several agencies throughout the state that can help homeowners with basic repairs.

West Virginia Department of Economic Development Weatherization Assistance Program–serving statewide

https://wvcad.org/sustainability/weatherization-assistance-program or 800-982-3386

West Virginia Department of Economic Development Emergency Repair or Replacement Program–serving statewide

https://wvcad.org/sustainability/errp or 800-982-3386

USDA Single-Family Housing Repair Loans & Grants–serving rural areas statewide (enter your address on the website to determine eligibility)

https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-repair-loans-grants/wv or 304-284-4860

North Central West Virginia Community Action Weatherization Program–serving Barbour, Greenbrier, Marion, Monongalia, Pocahontas, Preston, Randolph, Taylor, and Tucker counties

https://ncwvcaacorp.net/programs/weatherization/ or 304-457-3420

Mountain CAP of West Virginia Weatherization Program–serving Upshur, Webster, Lewis, and Braxton counties

https://www.mountaincapwv.org/about1 or 304-472-1515

Mountain Cap of West Virginia Emergency Repair & Replacement Program–serving Braxton, Upshur, and Webster–304-472-1500

https://www.mountaincapwv.org/ or 304-472-1500

CASE West Virginia Weatherization and Emergency Repair & Replacement Program–serving Mercer, Summers, and Monroe counties

https://www.casewv.org/weatherization or 304-809-3055

EnAct Community Action Repair & Replace Program–serving Boone and Clay counties

https://enactwv.org/programs/no-heat-emergency-program/ or 304-414-4475

PRIDE Community Services Weatherization Program–serving Logan County

https://www.loganpride.com/weatherization-assistance-program/ or 304-752-6868

Coalfield Community Action Weatherization Program–serving Mingo County

https://coalfieldcap.org/weatherization or 304-235-1701

Southwest Community Action Council Emergency Repair and Replace Program and Weatherization Program–serving Cabell, Lincoln, Mason, and Wayne counties

https://www.scacwv.org/emergency-repair-and-replace-program or 3004-781-0929

Community Resources, Inc. Weatherization Program–serving Calhoun, Doddridge, Gilmer, Jackson, Ritchie, Roane, Tyler, Pleasants, Wetzel, Wirt, and Wood counties

https://cricap.org/weatherization/ or 304-485-5525

CHANGE, Inc. Emergency Repair & Replace Program and Weatherization Program –serving Brooke, Hancock, Marshall, and Ohio counties

https://changeinc.org/housing-assistance/#emergency-repair-and-replace or 304-797-7733

Central West Virginia Community Action Emergency Repair & Replacement Program –serving Harrison and Lewis counties

https://centralwvaction.org/services/housing-assistance/ or 304-622-8495

Pathways to Homeownership

The West Virginia Housing Development Fund helps people achieve the dream of homeownership every day. We offer 30-year, low-interest mortgage loans to qualified buyers, including first-time buyers. Visit the Home Buyers page of our website for more information about each program.

This program is geared toward first-time buyers, including those who have owned a home in the past but are purchasing their first home in West Virginia. Borrowers can finance up to 100 percent of the purchase price of the home, meaning a down payment is not always required. Applicants must meet income eligibility and credit requirements and the home must not exceed our established price limits. Borrowers are required to complete a homeowner education course.

This program is geared toward first-time buyers, including those who have owned a home in the past but are purchasing their first home in West Virginia. Borrowers can finance up to 100 percent of the purchase price of the home, meaning a down payment is not always required. Applicants must meet income eligibility and credit requirements and the home must not exceed our established price limits. Borrowers are required to complete a homeowner education course.

The Movin’ Up Program does not have a first-time buyer requirement and is instead geared toward moderate-income buyers who have outgrown their current home or simply want a change of scenery. The income and house price limits are a little higher than the Homeownership Program. Borrowers are required to complete a homeowner education course.

The West Virginia Veterans’ Home Loan Mortgage Program is the result of Senate Bill 261, signed into law in 2024. The program is funded by an $8 million transfer from the Unclaimed Property Trust Fund and offers low-interest rate mortgages to qualifying veterans, active service members, and surviving spouses. There are no income limits but a $350,000 sales price limit. Borrowers must be first-time home buyers, contribute $2,500 toward the transaction, and may take advantage of the Low Down Home Loan to cover down payment and closing costs, if they meet program eligibility.

The Low Down Home Loan makes it easier for borrowers to achieve the dream of homeownership. This low-interest loan is offered in conjunction with the Homeownership Program to reduce the amount of money borrowers pay up front to purchase a home. With the Low Down Home Loan, customers may borrow up to $8,000 to cover down payment and closing costs.

The Fund also partners with more than 50 banks, credit unions, and mortgage companies to provide our programs to borrowers throughout the state. To see if we partner with a lender in your area, visit www.wvhdf.com/lenders.

When you’re ready to purchase a home, call 1-800-933-8511 to speak with one of our experienced loan originators. They can answer your questions and guide you through the loan process.

RESOURCES FOR RENTERS

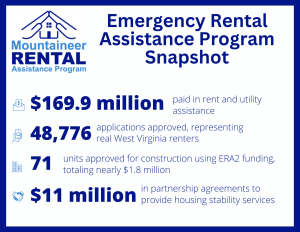

Emergency Rental Assistance Program

The Mountaineer Rental Assistance Program ended direct rental assistance on September 30, 2022. However, the program maintains partnerships with community-based organizations across the state to help eligible renters with housing stability issues. See below for a list of partner organizations:

West Virginia Coalition to End Homelessness

304-843-9522

Serving statewide

Randolph County Housing Authority

304-636-6495

Serving Randolph, Barbour, Tucker, Lewis, Upshur, and Pendleton

Fairmont Morgantown Housing Authority

304-363-0860

Serving Marion, Monongalia, Preston, and Taylor

Clarksburg Harrison Regional Housing Authority

304-623-3322

Serving Harrison

Housing Authority of Mingo County

304-475-4663

Serving Mingo, Logan, Wayne, McDowell, and Wyoming

Southwestern Community Action of West Virginia

304-525-5151

Serving Cabell, Lincoln, Mason, and Wayne

Mountain CAP

304-472-1500

https://www.mountaincapwv.org/

Serving Braxton, Webster, and Upshur

Greater Wheeling Coalition for the Homeless

304-232-6105

https://www.wheelinghomeless.org/

Serving Brooke, Hancock, Ohio, Marshall and Wetzel

Legal Help for Renters Program

Through a partnership with Legal Aid of West Virginia, MRAP-qualified renters are provided access to free legal representation for housing-related issues including, but not limited to: eviction, bad housing conditions, landlord/tenant relations, domestic violence, problems with utilities, and loss of benefits (such as Medicaid, food stamps, or unemployment).

Renters experiencing housing instability should call Legal Aid at (304) 343-3013 or visit www.legalaidwv.org to fill out a request for help. A Legal Aid representative will review your request and may contact you for additional information. If you have a case Legal Aid can assist with, you will be assigned an attorney to represent you in legal proceedings.

Legal Aid representation does not guarantee you a victory in court, but research shows that tenants who do have legal assistance are more likely to see more favorable outcomes.

Legal Aid’s website also features articles on topics such as housing discrimination, West Virginia tenant/landlord laws, tenant rights, and other helpful information.

The United Way 211

Although a formal partnership between the Mountaineer Rental Assistance Program and 211 no longer exists, renters may still contact 211 for help with utility payments and other needs. Renters can contact 211 by:

- Dialing 2-1-1 from your mobile device. (Please note that some phones that use VOIP (Voice Over Internet Protocol) or Wifi calling might not be able to reach 2-1-1. In that case, call 1-833-848-9905.)

- Texting your Zip code to 898-211.

- Visiting the 211 website at www.wv211.org and clicking “Chat” to speak with a specialist online.

West Virginia Department of Health and Human Resources

The Low Income Energy Assistance Program (LIEAP) helps eligible households with their heating bills through direct cash payments or payments to utility companies on their behalf. Emergency assistance is available for households without resources facing the loss of a heating source. Eligibility for both program components is based on income, type of heating payment, and total heating costs, among other factors.

The Division of Family Assistance (DFA) operates LIEAP in each DHHR field office each winter and usually sends a letter to targeted households. DFA also contracts with the Community Action network and with regional Agency on Aging offices to perform outreach and accept LIEAP applications at their local sites.

Similarly, the Low-Income Household Water Assistance Program provides assistance on water and wastewater bills for qualified low-income households. Eligibility for this program is based on household size and income. Households disconnected from service or with a pending disconnection because of unpaid bills or those who need help with current bills may qualify.

West Virginia also has a Special Reduced Rate Service Program (20% Utility Discount Program) to provide eligible households a 20 percent discount on their gas, electric and water bills. Recipients of SNAP and over age 60, SSI and over age 18, or WV WORKS may be eligible.

For information on these programs, visit https://dhhr.wv.gov/bfa/programs/Pages/default.aspx. To see the full list of DHHR field offices, visit https://dhhr.wv.gov/bfa/Pages/MapList.aspx.

Affordable Rental Properties

The West Virginia Housing Development Fund has financed the construction or rehabilitation of more than 500 affordable housing developments throughout the state. Low- to moderate-income renters, including seniors and families, can find affordable units at www.wvhdf.com/portfolio-properties. This database is searchable by city, county, and population served. Please call the property directly to inquire about available units and cost.