The Homeownership Program makes homeownership more affordable for West Virginians. Primarily targeting first-time home buyers, the Homeownership Program generally offers our lowest interest rates and is compatible with the Low Down Home Loan, offering down payment and/or closing cost assistance.

These 30-year, fixed-rate loans can finance up to 100% of the home’s purchase price.

Program Eligibility and Limits

To qualify for a Homeownership Program Loan, borrowers must meet three criteria:

- The borrower’s gross income must not exceed the income limits in the county where the home is being purchased.

- The house to be purchased must not exceed the house price limits in the county where the home is being purchased.

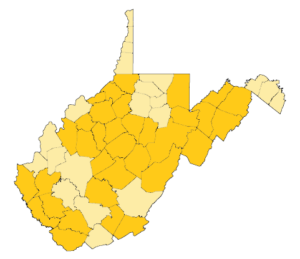

- Borrowers must not have had an ownership interest in their principal residence at any time during the three-year period ending on the date the program loan is closed if they intend to purchase a residence located in one of the following non-targeted counties: Barbour, Berkeley, Boone, Brooke, Cabell, Greenbrier, Hancock, Harrison, Jefferson, Kanawha, Marion, Marshall, Mason Mercer, Monongalia, Morgan, Ohio, Putnam, Raleigh and Wood counties.

- This requirement does not apply to residences located in targeted counties which are all counties highlighted on the map, nor does it apply when the borrower is an eligible veteran under the Heroes Earnings Assistance and Relief Tax Act of 2008.

House price and income limits vary by county and household size. You can see the limits for your county by clicking the button below.

2024 House Price and Income Limits (5/31/2024)

Low Down Home Loan

In most cases, borrowers may qualify for help with their down payment and closing costs through our Low Down Home Loan. This is available only with the Homeownership Program and through a WVHDF Participating Lender. This loan offers up to $8,000 when loan-to-value is at or above 80%.

Please refer to the Low Down Home Loan page for more information.

Frequently Asked Questions

What kind of home can I purchase?

Single-family structures, townhomes and units in approved Planned Unit Developments or condominiums and new double-wide manufactured homes. All must be located in West Virginia.

Is there an acreage limit?

Property conveyed with the home transaction cannot exceed five acres.

Is construction financing available?

Permanent financing is available for newly constructed homes. Construction financing is not available.

What types of mortgage insurance does the Fund accept?

We take all mortgage insurance including FHA, VA, USDA and private mortgage insurance.

Do I have to participate in Homebuyer Education/Counseling?

Homebuyer Education/Counseling is required for both the Movin’ Up and Homeownership programs on conventionally insured or uninsured loans. On the government insured loans (FHA, VA, and USDA) follow the insuring agencies guidelines for Homebuyer Education/Counseling requirements. Information on counseling providers in West Virginia may be found here or with your mortgage insurance (MI) provider.

Update – Our requirement that income from all household occupants over the age of 18, excluding those dependents who are enrolled as a full-time student, is being amended to only include the income of all parties on the note and/or taking title to the property.

*Please note that any and all APR calculations presented throughout this website are based on a sales price of $100,000 with a 5 percent down payment.

Video: Are You Ready for Homeownership?

Buying a home is a big decision, and not one that should be taken lightly. There’s a lot a potential homeowner must consider, including their credit history and financial situation. Before you call us to begin the mortgage process, we encourage you to watch the short video below to help you determine if you’re ready for homeownership.